The goal of life insurance is to provide a measure of financial security for your family after you die.

How Life Insurance Works

In simple terms, life insurance is a contract between an individual and a life insurance company whereby the life insurance company will pay a lump sum to the individual upon death in exchange for a specific amount of premium, normally paid monthly or annually.

“One in four breadwinners in the UK do not have a life insurance policy in place potentially leaving their families open to financial problems if they died.

This equates to almost 8.5 million Brits that have failed to protect their family income upon death. What’s more surprising is that 85% of the population admit to having inadequate cover but fail to take any action”

Types of Life Insurance

There are two types of Life Insurance, term cover and whole of life cover. The below diagram helps explain the differences between the two;

Term Cover

Provides coverage for a specific amount of time, for example, 10 years

There is a monetary value that is paid to the named beneficiary in the event that the policyholder dies within the specific period

The premium must be paid in order to keep the policy in force

The insurance does not grow in cash value and is not used as an investment

Term Cover is often cheaper than whole of life cover

Whole of Life

This type of cover is in force for the life of the policyholder, as long as premiums are paid the policy has a cash value, and is linked to investments, which means that in some cases the policy can be ‘cashed in’

Although more expensive than term cover, it is certain that you will at some point make a claim, where as if you pass away outside of the term in which you are covered with term cover, there will be no payment.

LIFE INSURANCE – REASONS & FACTORS

The major reason for purchasing life insurance is to guarantee the continued financial support of loved ones who depend on the insured in the event of the insured’s death.

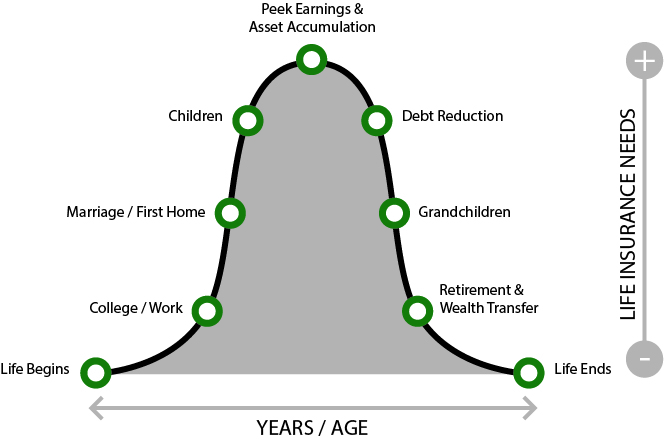

Life Insurance Needs Curve